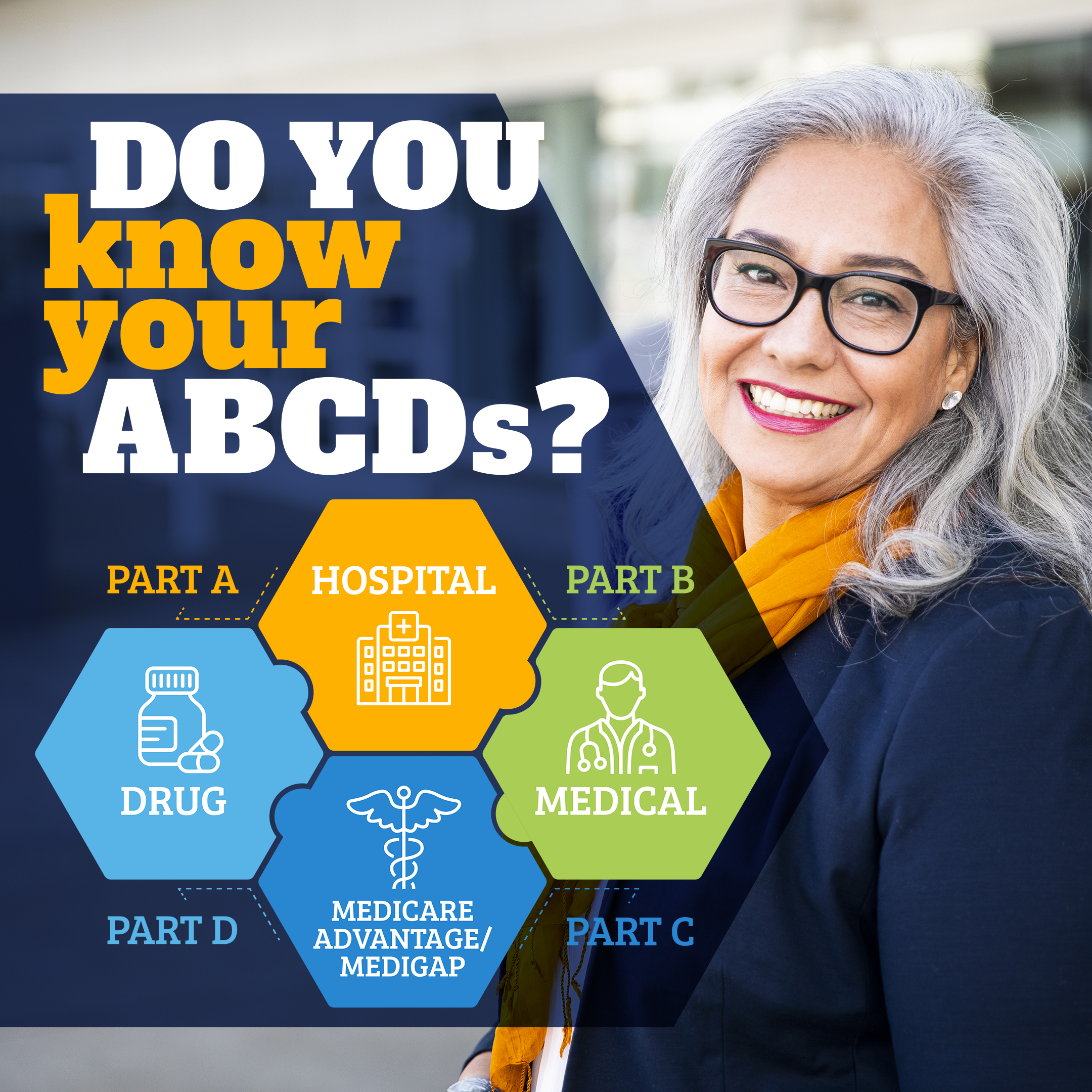

What Are The Different Parts Of Medicare?

Part A (Hospital Insurance): Helps cover:

- Inpatient care in hospitals

- Skilled nursing facility care

- Hospice care, and home health care.

Click here to learn more: What Part A covers | Medicare

Part B (Medical Insurance): Helps cover:

- Services from doctors and other health care providers

- Outpatient care

- Home health care

- Durable medical equipment (like wheelchairs, walkers, hospital beds, and other equipment)

- Many preventive services (like screenings, shots or vaccines, and yearly “Wellness” visits)

Click here to learn more: What Part B covers | Medicare

Part D (Drug coverage): Helps cover:

- The cost of prescription drugs (including many recommended shots or vaccines).

- You join a Medicare drug plan in addition to Original Medicare, or you get it by joining a Medicare Advantage Plan with drug coverage.

- Plans that offer Medicare drug coverage are run by private insurance companies that follow rules set by Medicare.

Click here to learn more: What Medicare Part D drug plans cover | Medicare

What is Original Medicare?

- You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

- Original Medicare includes Part A and Part B. Under original Medicare, you are responsible for the following:

- Part A deductible, which can occur up to 4 times per year.

- Part B deductible, which occurs once per year.

- 20% of the medical bills (Medicare pays 80%)

- Original Medicare does not include medication coverage (Part D). You can join a separate Medicare drug plan or Medicare Advantage plan with prescription drug coverage.

Do I have to stay with just original Medicare coverage?

No, you have some great choices! Because Medicare coverage is not complete, most people (86%) choose some form of additional coverage.

At Generations, our customers are family, and we take the time to walk through all the options with you and find Medicare Supplement, Medicare Advantage (Part C) and Prescription Drug Plans that best suits your needs.

What are some options instead of keeping Original Medicare?

Medicare Advantage (also known as Part C)

- Medicare Advantage plans are Medicare-approved plans managed by private health insurance carriers.

- These “bundled” plans are an all-in-one package that include Part A, Part B, usually Part D, and additional extra benefits.

- Plans may offer low or no deductibles for health and medication coverage and have lower out-of-pocket costs than Original Medicare.

- Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental coverage and services.

Medicare Supplemental Insurance (also known as Medigap):

Medicare Supplement plans supplement Original Medicare by paying your 20% coinsurance of medical bills that Original Medicare does not cover. In addition, Medicare Supplement plans can be customized in Wisconsin to best suit your needs.

In addition to paying your 20% Medicare coinsurance for you, plans have “riders” that can be added to base plans. Riders that can be added are the following:

- Part A deductible (100% coverage)

- Part A deductible (50% coverage)

- Additional 365 days of home health care

- Part B deductible (100% coverage) (Only available if eligible for Medicare before 1/1/2020)

- Part B coinsurance

- Adding the Part B coinsurance rider will add copays of up to $20 for a doctor visit and up to $50 for the emergency room. In exchange, your monthly premium will be less than a base supplement policy.

- Part B excess charges

- Foreign travel emergency

Note: Each rider has a cost that will either add or subtract from the base cost of the basic plan.

Medicare Late Enrollment Penalties

Unfortunately, Medicare can assess penalties for the late enrollment of Medicare Part A, B or D. Click here to learn more: Avoid late enrollment penalties | Medicare